Endüstriyel Yapılar

Endüstriyel sanayi yapıları ve küçük sanayi yapıları alanında, yatırımlar çerçevesinde, ihtiyaçlarınızı diğer yapım metaryallerine göre en ekonomik ve en hızlı çözümlerimizle ELF BETON AŞ olarak karşılamaktayız.

Cephe Paneli

Cephe Paneli yapılarda duvar yerine alternatif olarak kullanılmaktadır. Desenli ve desensiz olarak tasarlanabilen bu elemanlar yatay ve düşey olarak üretimi yapılabilmektedir. Prefabrik Cephe Paneli, evler ve apartman blokları, ofis binaları, mağazalar, okullar, hastaneler, spor ve havuz kompleksleri, sanat merkezleri gibi birçok alanda kullanılabilir. Avantajları Kolay kurulumu sayesinde inşaat sürelerini azaltır. Daha az işçilik ile birlikte saha yönetimini de kolaylaştırır.

Cephe Paneli

Cephe Paneli yapılarda duvar yerine alternatif olarak kullanılmaktadır. Desenli ve desensiz olarak tasarlanabilen bu elemanlar yatay ve düşey olarak üretimi yapılabilmektedir. Prefabrik Cephe Paneli, evler ve apartman blokları, ofis binaları, mağazalar, okullar, hastaneler, spor ve havuz kompleksleri, sanat merkezleri gibi birçok alanda kullanılabilir. Avantajları Kolay kurulumu sayesinde inşaat sürelerini azaltır. Daha az işçilik ile birlikte saha yönetimini de kolaylaştırır.

Köprü Kirişleri ve Viyadükler

Bir ülkenin gelişmişliğinin simgesi olan köprüler,köprülü kavşaklar, viyadükler ve demir yolları gibi ulaşım sektöründeki bir çok alanda yapılan yatırımlara geniş ürün yelpazemiz ve büyük açıklıkları geçmek için uyguladığımız yüksek inşaat teknolojileri ile hizmet vermekteyiz.

Köprü Kirişleri ve Viyadükler

Bir ülkenin gelişmişliğinin simgesi olan köprüler,köprülü kavşaklar, viyadükler ve demir yolları gibi ulaşım sektöründeki bir çok alanda yapılan yatırımlara geniş ürün yelpazemiz ve büyük açıklıkları geçmek için uyguladığımız yüksek inşaat teknolojileri ile hizmet vermekteyiz.

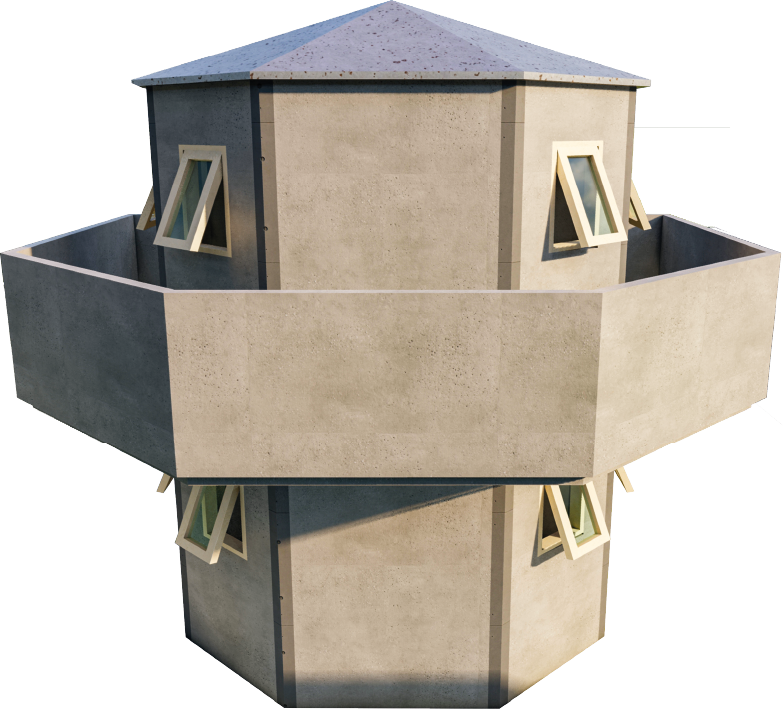

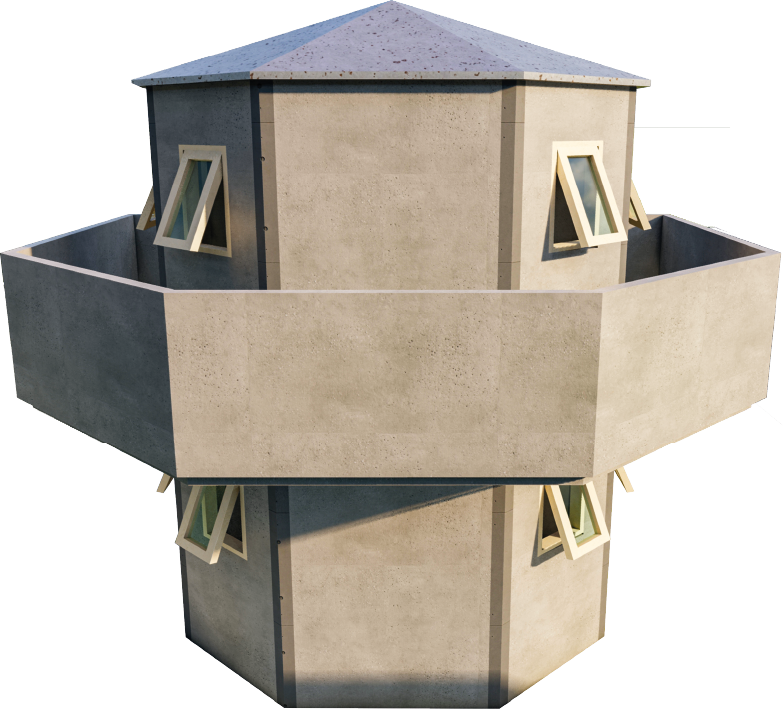

Savunma Sanayi Blast Balistik Beton

Günümüz şartlarında, giderek artan tehlike ve tehdit unsurlarına karşı, halkın huzuru ve güveni için emniyet ve güvenliği için binalarımızın daha güvenli hale getirilmesi konusu ön plana çıkmıştır. 3B Protection ürünleri diğer ürünlerle kıyaslandığında UL 1-10 seviyesindeki blast etkilerine karşı son derece dayanıklı ve ekonomiktir. Sertifikalı laboratuvarlarda test edilerek onaylanan bu ürün, blast, balistik, yangın ve bunların karışımı olarak ortaya çıkan tehditlere karşı üst seviyelerde mukavemet sağlar. Beton duvarlarla kıyaslandığında modüler sistem olarak uygulanan yapısıyla hızlı ve kolay bir şekilde ihtiyaç duyulan bölgede paneller değiştirilebilir. Bu ürünle roket saldırıları gibi blast etkisi altında kalabilecek eski binaların da güçlendirilebilmesi mümkün. Süratli üretim ve kolay montaj özellikleriyle öne çıkan bu balistik beton, tadilat için uygun çözümler sunarken, müşterinin taleplerine uygun üretim imkânı sağlar. Klasik binalarda ön cephe kaplaması ile tehlikelere karşı savunmayı üst seviyelere çıkarır. Büyük ölçekli projelerde 3B malzemeyi inşaatta direk kalıplara dökülebilecek şekilde üretimi yapılabilir. Aynı zamanda üretim şantiye sahasında yapılarak zamandan kazanarak maliyeti düşürecek tedbirler alınabilir. Bu uygulama malzemenin daha etkili kullanılmasına da olanak sağlar.

Savunma Sanayi Blast Balistik Beton

Günümüz şartlarında, giderek artan tehlike ve tehdit unsurlarına karşı, halkın huzuru ve güveni için emniyet ve güvenliği için binalarımızın daha güvenli hale getirilmesi konusu ön plana çıkmıştır. 3B Protection ürünleri diğer ürünlerle kıyaslandığında UL 1-10 seviyesindeki blast etkilerine karşı son derece dayanıklı ve ekonomiktir. Sertifikalı laboratuvarlarda test edilerek onaylanan bu ürün, blast, balistik, yangın ve bunların karışımı olarak ortaya çıkan tehditlere karşı üst seviyelerde mukavemet sağlar. Beton duvarlarla kıyaslandığında modüler sistem olarak uygulanan yapısıyla hızlı ve kolay bir şekilde ihtiyaç duyulan bölgede paneller değiştirilebilir. Bu ürünle roket saldırıları gibi blast etkisi altında kalabilecek eski binaların da güçlendirilebilmesi mümkün. Süratli üretim ve kolay montaj özellikleriyle öne çıkan bu balistik beton, tadilat için uygun çözümler sunarken, müşterinin taleplerine uygun üretim imkânı sağlar. Klasik binalarda ön cephe kaplaması ile tehlikelere karşı savunmayı üst seviyelere çıkarır. Büyük ölçekli projelerde 3B malzemeyi inşaatta direk kalıplara dökülebilecek şekilde üretimi yapılabilir. Aynı zamanda üretim şantiye sahasında yapılarak zamandan kazanarak maliyeti düşürecek tedbirler alınabilir. Bu uygulama malzemenin daha etkili kullanılmasına da olanak sağlar.

T-Wall Duvar

Eğimli arazilerde, göçme ihtimali olan zeminlerin kaymasını engellemede, bodrum duvarlarını oluşturmada,kıyı erozyonunu önlemek veya taşkınlardan koruma gibi yapılanmalarda konvensiyonel imalatlara göre daha hızlı ekonomik, ve estetik çözümlerlerle hizmet vermekteyiz.

T-Wall Duvar

Eğimli arazilerde, göçme ihtimali olan zeminlerin kaymasını engellemede, bodrum duvarlarını oluşturmada,kıyı erozyonunu önlemek veya taşkınlardan koruma gibi yapılanmalarda konvensiyonel imalatlara göre daha hızlı ekonomik, ve estetik çözümlerlerle hizmet vermekteyiz.

Tarımsal Yapılar

Endüstriyel sanayi yapıları ve küçük sanayi yapıları alanında, yatırımlar çerçevesinde, ihtiyaçlarınızı diğer yapım metaryallerine göre en ekonomik ve en hızlı çözümlerimizle ELF BETON AŞ olarak karşılamaktayız.

Tarımsal Yapılar

Endüstriyel sanayi yapıları ve küçük sanayi yapıları alanında, yatırımlar çerçevesinde, ihtiyaçlarınızı diğer yapım metaryallerine göre en ekonomik ve en hızlı çözümlerimizle ELF BETON AŞ olarak karşılamaktayız.

Boşluklu Döşeme

Ara kat yüklerini taşımak için tasarlanan boşluklu döşeme 50 kalınlık 120 cm genişliğe kadar projeye uygun bir şekilde tasarlanarak üretimi yapılmaktadır. Döşeme içerisindeki ölü yükleri azaltmak için içerisinde yaratılan boşluklar sayesinde büyük açıklıkları düşük maliyet ve ağırlıklarla geçmek gelişen prefabrik teknolojileri ile mümkün hale gelmiştir. Son teknoloji makinelerle üretimi yapılan boşluklu döşemeler öngermeli olarak üretilmektedir. Projeye uygun şekilde tasarlanan donatılar üretim bandına gerilerek üretime başlanır. Üretim tamamlandıktan sonra kürleme yapılarak sonlandırılır. Üretimi tamamlanan boşluklu döşemeler projeye uygun bir şekilde kesilerek stoklanır. Avantajları Prefabrik boşluklu döşeme elemanları zamandan ve maliyetten oldukça tasarruf sağlar Deprem ve yangın gibi afetlere dayanıklıdır. Isı ve ses yalıtımı sağlar. Montaj sonrası hasır çelik ve beton kaplama işlemleri ile döşemenin taşıma kapasitesi ve diyafram kabiliyeti artırılır. Döşeme içerisinde bulunan boşluklar sayesinde ürünün kendi ağırlığı hafiflerken kuvvet altında yapının şekil değiştirmeye olan direnci de artmaktadır. Öngerme teknolojisi sayesinde üretim sırasında oluşan ters sehim uygulama sırasında oluşacak sehimi azaltarak büyük açıklıkları geçmeye olanak tanırken faydalı yük taşıma kapasitesini de artırmaktadır.

Boşluklu Döşeme

Ara kat yüklerini taşımak için tasarlanan boşluklu döşeme 50 kalınlık 120 cm genişliğe kadar projeye uygun bir şekilde tasarlanarak üretimi yapılmaktadır. Döşeme içerisindeki ölü yükleri azaltmak için içerisinde yaratılan boşluklar sayesinde büyük açıklıkları düşük maliyet ve ağırlıklarla geçmek gelişen prefabrik teknolojileri ile mümkün hale gelmiştir. Son teknoloji makinelerle üretimi yapılan boşluklu döşemeler öngermeli olarak üretilmektedir. Projeye uygun şekilde tasarlanan donatılar üretim bandına gerilerek üretime başlanır. Üretim tamamlandıktan sonra kürleme yapılarak sonlandırılır. Üretimi tamamlanan boşluklu döşemeler projeye uygun bir şekilde kesilerek stoklanır. Avantajları Prefabrik boşluklu döşeme elemanları zamandan ve maliyetten oldukça tasarruf sağlar Deprem ve yangın gibi afetlere dayanıklıdır. Isı ve ses yalıtımı sağlar. Montaj sonrası hasır çelik ve beton kaplama işlemleri ile döşemenin taşıma kapasitesi ve diyafram kabiliyeti artırılır. Döşeme içerisinde bulunan boşluklar sayesinde ürünün kendi ağırlığı hafiflerken kuvvet altında yapının şekil değiştirmeye olan direnci de artmaktadır. Öngerme teknolojisi sayesinde üretim sırasında oluşan ters sehim uygulama sırasında oluşacak sehimi azaltarak büyük açıklıkları geçmeye olanak tanırken faydalı yük taşıma kapasitesini de artırmaktadır.

Projeler

Projelerimize genel bakış

Referanslar

Galeri

Köprü Kirişleri Ve Özel İmalatlar

Savunma Sanayi İçin Özel Yapılar

Savunma Sanayi İçin Özel Yapılar

Savunma Sanayi İçin Özel Yapılar

Güvenlik Duvarları İçin Özel İmalatlar

Hacettepe Üniversitesi İçin Özel İmalatlar

Akyurt Köprülü Kavşak 1 Projesi

Türk Telekom Alt Geçidi Projesi

İletişim

İletişime Geçiniz

İletişim Bilgilerimiz

Merkez Ofis:

+90 312 844 24 24

Çınar Mah. Çankırı Bulvarı No:102/3 Akyurt/Ankara

elf@elfbeton.com.tr

Akyurt Fabrika:

+90 312 844 24 24

Çınar Mah. Çankırı Bulvarı No:102/2 Akyurt/Ankara

elf@elfbeton.com.tr

Kalecik Fabrika:

+90 312 844 24 24

Kızılkaya Mah. Çankırı Yolu 57. Km No:45 Kalecik/Ankara

elf@elfbeton.com.tr